Archive for October 2018

4 Trade-Offs Between Repossession Fees and Recovery Results

Repossession services are available through multiple providers so why pay more than what the low-cost provider is willing to accept? The image illustrates four trade-offs between repossession fees and recovery results. When recovery fees are driven down to rock bottom levels, the service provider (whether a direct agent or a forwarder/skip company) is typically forced…

Read MoreWebinar: Optimizing Repossession Results Through Effective Vendor Score Carding

Nothing impacts repossession results more than setting up effective competition between your vendors using well-constructed vendor scorecards. The score card techniques used by major vendors have evolved significantly over the past few years, incorporating both recovery and compliance performance. This webinar recording will review several different approaches used by leading lenders and will provide insights…

Read MorePersonal Property and Redemption Practices by Auto Lenders

Did you know that over 40% of lenders don’t allow repo agents to charge fees directly? We recently asked over several auto lending institutions to participate in a survey that covered the scope of allowable fees and institution practices. Over 50 institutions provided information on personal property and redemption. The results were very interesting! We want…

Read MorePre-Charge Off Skip Trace – Is It Worth The Money?

Available industry data is clear, if a repossession agent has not recovered a vehicle within 30 days of working it properly, the recovery rate after that point is typically in the 6%-9% range. This reality provides a strong incentive to rotate the assignment to a different provider in order to improve the likelihood that a…

Read MoreHow Repo Agents Evaluate Lenders & Forwarders – A Look Into an Agent’s Metrics

Guest Author: Jeremy Cross President at International Recovery Systems Recently, I have had the opportunity to travel to various repossession related events, and in attendance were many lenders, agents and forwarders. Of the many conversations that took place, and there sure is a lot of them, one kept popping up- how do you evaluate…

Read MoreVendor Score Carding Strategies for Auto Lenders

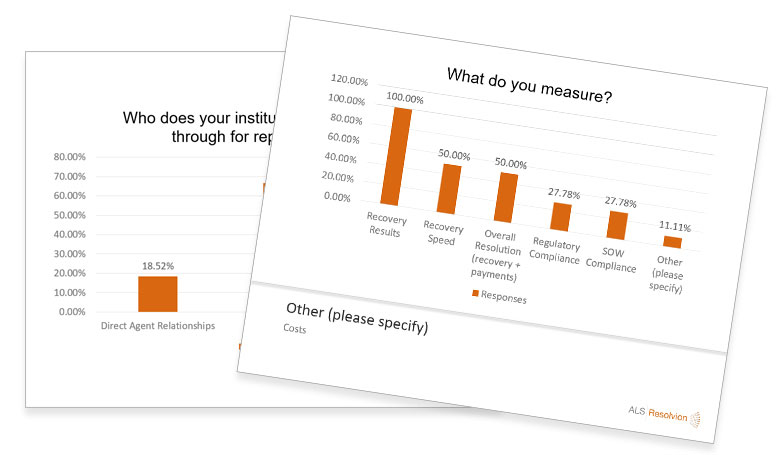

We recently surveyed over 100 lenders to gauge different score carding strategies. The survey results were very informative and gave insight into different techniques used by auto finance lenders of all sizes. We were surprised that over 20% of lenders don’t allocate market share based on vendor score cards! Our survey consisted of questions regarding…

Read More