Repo Agent Effort – In Today’s Environment, Expect To Get What You Pay For

The relentless drive to reduce repossession related costs while, at the same time meeting the demands/expectations of regulators, may be catching up with us. As one of the largest repossession management firms, we stay very close to the dynamics of the marketplace and we have become concerned about the current situation and even more concerned about the potential impact in the future.

There are several dynamics that are affecting the current agent environment. First and foremost, the cost of operating has increased significantly in recent years. The investment that agencies have had to make in technology and compliance are really significant. Unfortunately, there has been little opportunity to pass on those costs. Some have managed to adapt well. Many others are just barely hanging on. Rarely does a week go by where an established agency somewhere does not close its doors. That trend is likely to continue.

The result is that the agent ranks have thinned and the high cost of entry/compliance makes it very difficult for new companies to enter. Add to that the emerging trend of agency consolidation (i.e. Location Services) and increases in cases emanating from the huge origination volume in recent years and you get the picture. Beyond the short-term operational impact, the situation may also leave the industry unprepared for the likely growth in repossession cases that will come from the inevitable slowing of the economy.

So, what does this mean to the lenders and their forwarding/skip partners? First, we may not have the density of agent network that is really needed to optimize recovery performance. Without going into a long explanation, suffice it to say that fielding a large enough agent network to have at least 3 agency options for any given assignment is important to performance management. A potentially bigger impact, which we are already starting to see, is that the better agents are choosing the business that they accept and, even within the business they accept, very conscious decisions regarding resource allocation are being made.

Who Is Grading Who?

As a forwarding company serving many large lenders, we are used to getting score carded by our clients and we are used to score carding the performance of our agents. These scorecards are used to determine business flow to us and the agent. What we are not used to is getting a scorecard from our agents with guidance on which client portfolios are meeting profitability requirements and which are not. Granted, this trend is in its early stages but we see it growing and industry leaders, trade associations, etc. are actively educating their brethren on the merits. The bottom line, repossession agencies have the data and volume of business to determine where it makes sense to deploy their resources and where it does not.

Understanding Their Metric

It is important to understand how the savvier agents are evaluating our portfolios because it gives important insights into how certain decisions we are all making may affect the success our repossession efforts.

While there are a variety of different approaches, the metric that seems to be getting the most traction (and frankly makes the most sense) is “revenue per assignment”. This simple but elegant metric takes into consideration all of the key drivers including recovery rates as well as all ancillary revenue such as key cutting, storage, personal property handling, redemption related fees, etc. All of these elements work together to give the agent a true view of the client’s business. It is not all about the repo fee.

For example, the issue of personal property and redemption related fees has been a very hot topic over the past year because of CFPB scrutiny. There is no question that the issue needed to be standardized by the lenders. Some lenders have understood the implication of setting costs and have set parameters that pretty clearly meet the “reasonableness” standard required under most state laws while, at the same, time providing reasonable compensation to the agent for the services. However, others have taken the position that “less is better” in the eyes of the regulator and they have mandated very little or no fees are allowed. For agents that use the revenue per assignment metric, this position is penalized heavily in the metric and you can bet that recovery rates are also impacted as a result.

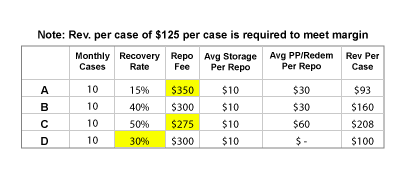

The table below illustrates the issue across four different scenarios. Clearly, under the revenue per case metric, the most profitable client can be the one with the lowest fee, if the recovery rate is good and the other parts of the equation are reasonable. However, combine a low fee with a low recovery rate and the business just won’t make sense for the agent to put much effort into.

The implication is pretty clear. Portfolios that offer the agent the opportunity to earn a reasonable margin will get the attention and resources. The ones that don’t…. won’t.

Download a Free PDF Copy to Read

Get a PDF copy of our article “Repo Agent Effort – In Today’s Environment, Expect to Get What You Pay For” to read later or share among your coworkers and colleagues. Should you have any questions, contact our team.