Resolvion Insights

At Resolvion, we believe that an important part of our role is to provide our clients with insights into current issues and best practices. To that end, we write articles, sponsor research, survey best practices, and host industry events. Visit this section of our site regularly for updates.

Resolvion Welcomes Mike Thomas as New Chief Executive Officer

FOR IMMEDIATE RELEASE Resolvion Welcomes Mike Thomas as New Chief Executive Officer Charlotte, NC, April 1, 2024 – Resolvion, a premier provider of repossession management solutions, is pleased to announce the appointment of Mike Thomas as its Chief Executive Officer. With a distinguished career in the financial services sector, Thomas brings to Resolvion…

Key Issues Surrounding All in One Repossession Pricing

When it comes to auto repossession services, all in one pricing can, indeed, offer benefits in these areas. However, as many lenders have come to understand, it must be approached very carefully and requires fairly deep analytics to gain a clear view of where the pricing should fall. Here are the key issues surrounding an…

How to Get More Out Of Your Skip Tracing

Article by Will Turner at TEC Services Group: http://tecsg.com/analyticalperspectives/get-skip-tracing/ Ask five people what the best skip trace tools and techniques are to find John Doe and you are likely to get five different answers. Why? It is relative. Searching for a missing child you’d likely have different time and money limitations than searching for…

Recovery Solution: 4 Things to Know About LPR Staging

It is important to understand that a true staging strategy involves capitalizing on real time (live) vehicles sightings vs. the use of historical LPR hits that occurred anywhere from several hours to several months ago. Over the past several years, the use of LPR technology has had a huge impact on recovery rates. Here are…

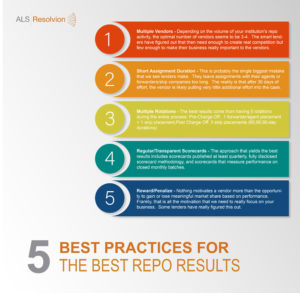

5 Best Practices For Better Car Repossession Results

Here are 5 best practices to produce to the best auto repossession results! As one of the largest repossession management companies in the country, we work with some of the largest auto lenders in the country. We’re happy to share with you our experience as to what we see as the key components of a…

Are You Buying a Repo Service or a Repo Result?

Over the years, repossession and skip tracing services have come to be viewed somewhat as commodities by many in the lending community. As such, outside of compliance, the primary focus around the management of these services has been cost. After all, since these services are available through multiple providers, why pay more than what the…

All-in-One Pricing Offers Potential Benefits But…

Over the past 12-18 months, there has been a real increase in interest by lenders around the idea of establishing “all in one pricing” (AiO) with their repossession forwarders. Most of this interest has been spurred by concerns expressed by the CFPB regarding ancillary fees as well as a desire by lenders to simplify the…