LPR Management – The Key to Faster Auto Repossessions

If you ask a handful of repossession managers about their top goals, it would be recovering more cars, lowering the average days to repossession, speeding up vehicle auction sales, and reducing overall costs. Outside of remaining compliance, most repossession and loss mitigation managers are focused on these metrics. There are many ways to accomplish these goals but one strategy for optimizing the entire collateral recovery process is utilizing License Plate Recognition (LPR) technology. This technology has the ability to augment ANY repossession strategy and does not work in competition or replace existing recovery efforts.

Using LPR data can not only improve repossession performance but increase overall efficiency. In fact, the use of LPR has had a huge impact on vehicle repossessions in the past several years. While traditional repossession activity focuses primarily on where people live and work, LPR data focuses on everywhere else.

This article will examine the keys to a successful LPR management strategy and how repossession managers and those alike can implement it within their departments.

What Is LPR Management?

The use of LPR data is managed in two ways: historical LPR hits and live LPR staging. Historical license plate data can be purchased from third-party providers and used internally to make informed repossession decisions based on where the vehicle was last seen. Live LPR staging is a third-party service provided by nationwide repossession management companies which involves active monitoring of license plate hits 24/7 and 365 days a year. Which LPR management strategy is right for you? The answer to this question is more complicated than you think and it involves analyzing your department budget, internal resources, and system integrations. It’s important to understand that a true staging strategy involves capitalizing on real-time license plate hits vs. the use of historical LPR hit data that occurred anywhere from several hours to several months ago. For many lenders, utilizing a live LPR management strategy brings additional benefits that outweigh the costs associated with implementing it.

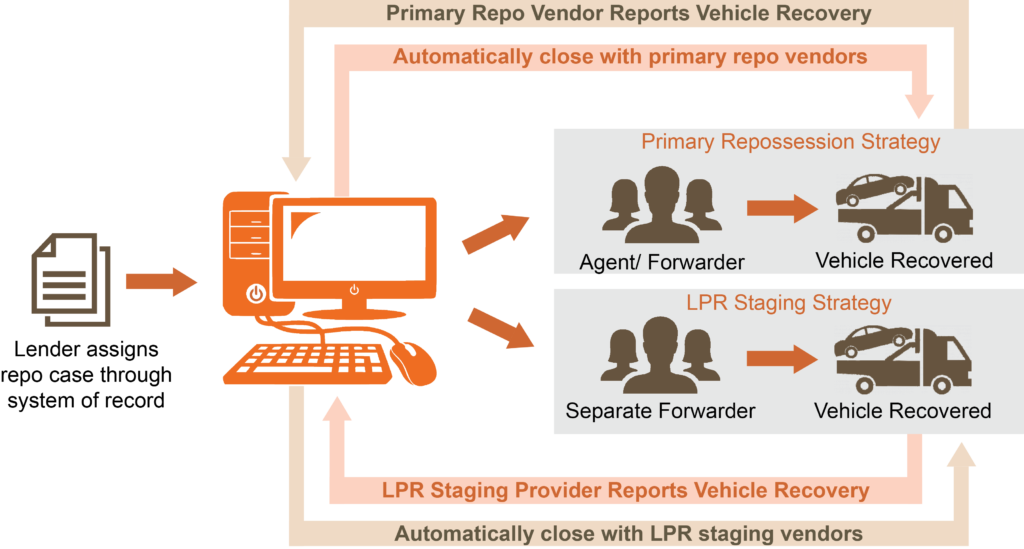

The diagram below provides a graphical summary of how an effective staging process should work.

Selecting the Best LPR Management Service Provider

By working with a nationwide repossession management company (forwarder) that is capable of responding to vehicle sightings 24/7/365, you will recover 3x the number of vehicles. A live LPR management service is designed to run concurrently with your primary auto repossession strategy (agent, forwarder, skip). In other words, regardless of where the involuntary repossession assignment resides, lenders also have all of their open assignments with one or more LPR service provider as a supplemental strategy.

When choosing an LPR management firm, it’s important to understand that not all LPR users are equal. There are significant differences in the density of LPR coverage offered by different forwarders. A firm that has contracted with 95%+ of DRN’s affiliates is going to scan more license plates and pick up a lot more cars than a firm that has contracted with only 75% of the network. In addition, your partner needs to operate a true 24/7/365 dispatch center. Not all providers do. If your vehicle’s license plate is located at 8 PM, your LPR provider needs to be available to verify holds/closes and quickly repossess the vehicle on the spot. With that said, another factor to consider is the speed that your LPR management firm can issue a repo order to an agent who has called in with a live hit. This can make a big difference. Many recoveries are lost due to the wait time. Many scenarios can happen if a repo order isn’t issued quickly such as the customer arriving to the scene and stopping the repossession process.

Implementing a Successful LPR Management Strategy

When it comes to implementation, one of the most important issue is to ensure that when a vehicle is recovered by either the assigned agent/forwarder or the LPR management service provider, information is communicated in real time to ensure that the case gets closed by the non-recovering party.

There are two critical elements to consider, system integration and well-defined processes. These are important to making an LPR staging strategy work smoothly, from both an administrative and compliance perspective. If you are using one of the primary industry management platforms (IREPO, RDN, IBEAM) and if your staging service provider is integrated into the platform, you should have no problem as each has the capability to manage multiple assignment types on the same VIN. If you don’t utilize one of the industry management platforms mentioned above, many forwarders have their own proprietary platform and can provide you with access to uploading VINS. This allows you to still implement a staging strategy.

If you can deal with the system, administrative, and process requirements, there is little downside and a lot of benefits to deploying a live LPR management strategy.

Test out the power of LPR for yourself. Contact us to get a FREE and commitment-free LPR hit analysis on vehicles that you have put out for repossession but have not recovered. We’ll run an analysis against our database of almost 3 billion LPR hits to see which and how many of those cars would have been recovered through the live LPR service. We’ll provide you with a spreadsheet of the results.