Auto Repossession: Vendor Score Carding Strategies

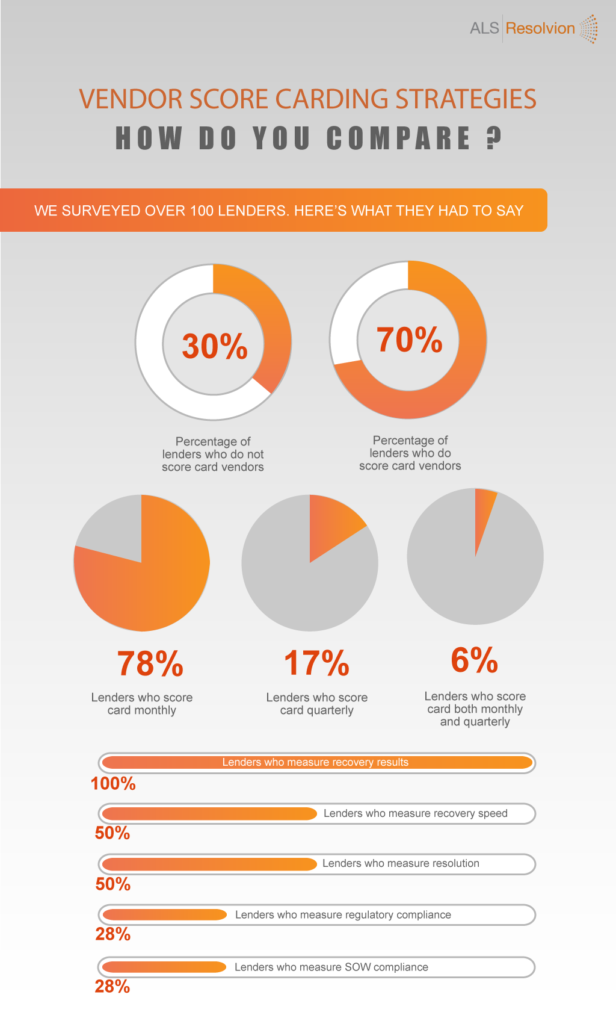

We surveyed over 100 auto lenders in regards to vendor score carding strategies. Here’s a visual look of the results.

- 67% of auto lenders use nationwide repossession management companies to manage their asset recovery

- 70% score card their vendors while 30% don’t

- 78% give their repossession vendors score cards on a monthly basis

- 17% give their repossession vendors score cards on a quarterly basis

- 6% score card vendors monthly AND quarterly

- 100% of auto lenders measure recovery results

- 50% of lenders measure recovery speed or the overall resolution (recovery + payments)

- 28% measure for regulatory compliance on score cards

- Although many lenders allocate market share based on score card results, 22% don’t

When asked how they measure recovery results, the answer was not unanimous. In fact, it was across the board. 35% of lenders measure recovery results in discrete monthly batches, 39% measure results by using a formula of “total recoveries for the period divided by total assignments still open,” and 27% use a completely different formula to calculate recovery results.

Click here to download the infographic