Repossessing Collateral? Know Your Repossession Agent

Source: https://www.equipmentfa.com/blogs/31333/repossessing-collateral-know-your-repossession-agent

Anytime you must repossess collateral, the lender assumes meaningful risk. Involuntary repossession, by definition, is often a hostile situation that can lead to a host of problems. Given that courts have found repeatedly that lenders are responsible for the acts of their sub-contractors, it is critical that your organization ensures that repossession agents doing work on your behalf are vetted up front and continuously monitored on key issues.

Proper Vetting

With industry requirements constantly changing for agents, here are the steps we recommend be undertaken before doing business with a repossession agency:

- Background checks on all principles

- Obtain copies of all required licenses/bonds

- Detailed insurance review (per clearly defined coverage requirements)

- Reference/client checks

- Employee training process

- Site visit – every storage location

- Physical security

- Data security

- Policies and procedures

Proper Contract and Documentation

It is also essential that the relationship be codified via a comprehensive contract that contains the following requirements:

- Background check on ALL new employees (repeated every 3 years)

- Drug screening on all new employees

- No sub-contracting of repossession work

- Detailed specifications of insurance requirements

- Secure and proper record retention

- FULL indemnification

- Handling of personal property – particularly important given today’s regulatory environment

- Service standards

- Complaint handling procedures

- Fee schedule

Insurance Requirements

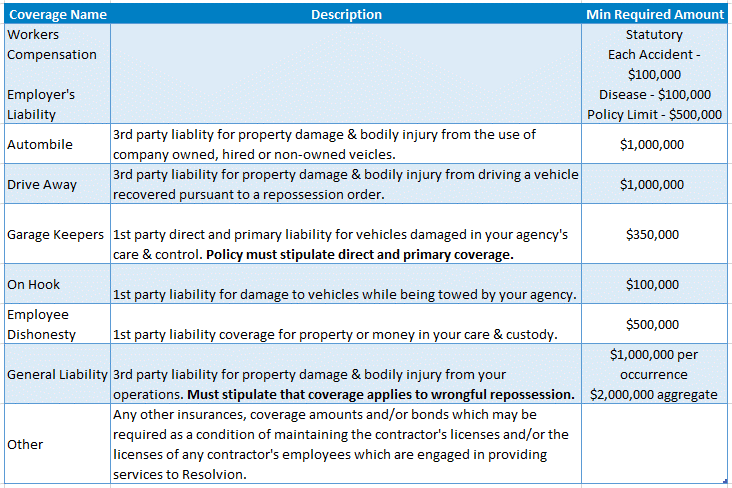

When it comes to heavy equipment repossession, proper insurance coverage is critical. To be properly protected, your agent needs to carry a variety of different coverages that provide protection under different events and circumstances. The table below reflects my firms experience as to what is required.

*The minimum insurance coverage required hereunder is as follows:

Also, your institution should always be named as an additional insured on the agent’s policy.

Ongoing Agent Monitoring

As with many vendor relationships, proper measures must be put in place for continued monitoring as changes in your agent’s operations can occur over time.

A robust monitoring program, that will provide true peace of mind, should include:

- Annual site visit/inspection

- Attestation of compliance with contract provisions

- Sampling of records audit

- File audit

- Documentation

- Licenses

- Bonds

- Insurance review/verification

Equipment Specific Experience

When it comes to equipment repossession, it is also critical to understand the agent’s experience with that type of equipment. Unlike standard automobiles, commercial equipment often requires special handling and storage. Without the right knowledge/experience the equipment may be damaged resulting in costly repairs. We have seen many examples of this over the years.

Summary

Recovering heavy equipment collateral is no small task but with the right partner(s) by your side, it is manageable. If your organization works with repossession agents directly, the information in this article will help you pick the right providers.

Another option for equipment portfolio managers is utilizing a national repossession management company that handles the entire repossession process and takes the legal/financial responsibility for their action. National repossession management firms, like Resolvion, often have tools and investigative resources that you will not often find in a local repossession agency.