Guest Contribution

Forwarders Role in Repossession, Recovery, and Remarketing

Original Source: Auto Remarketing Written by: Nick Zulovich at Cherokee Media Group Resolvion Executive Vice President Jose Mendiola didn’t mince words when asked by SubPrime Auto Finance News about what it’s been like for forwarding companies and other operations associated with recoveries since the pandemic began. “Repossessions being off almost 50% has put a…

Read MoreRepossessions and Bankruptcy: What the Fulton decision means for turnover

Written by: Rudy Cerone at McGlinchey Original Source: https://www.autofinancenews.net/allposts/auto-finance-excellence/compliance/repossessions-and-bankruptcy-what-the-fulton-decision-means-for-turnover/ The February Supreme Court decision in City of Chicago v. Fulton was widely celebrated in the lending community because the court found that a lender who repossesses a vehicle before a borrower files for bankruptcy is not in violation of the “exercise control” provision of the Bankruptcy…

Read MoreThe Repo Alliance: An Attempt to Standardize the Repo Industry

Exclusively written for Resolvion by Janina Burnell. The repossession industry has been forced to act to protect itself in the current climate, intensified by the recent pandemic. The Repo Alliance is a fundraising body that brings together several groups looking to serve a common interest. It started out with the American Recovery Association (ARA) and has…

Read MoreRepossessing Collateral? Know Your Repossession Agent

Source: https://www.equipmentfa.com/blogs/31333/repossessing-collateral-know-your-repossession-agent Anytime you must repossess collateral, the lender assumes meaningful risk. Involuntary repossession, by definition, is often a hostile situation that can lead to a host of problems. Given that courts have found repeatedly that lenders are responsible for the acts of their sub-contractors, it is critical that your organization ensures that repossession…

Read MoreSix Takeaways from Beyond the Curve: The Great Reset from Collections to Repossessions

Source: The Monitor Daily Monitor Live+ Beyond the Curve: The Great Reset from Collections to Repossessions was held on Tuesday, June 23. Bob Rinaldi, president of Rinaldi Advisory Services, moderated the live event. Rinaldi was joined by a panelist of industry leaders, including Debbie Devassy, shareholder at Askounis & Darcy; Deb Stibbe, associate vice…

Read MoreWhere Sub-prime Lenders Can Incorporate Predictive Modeling for Loans

Author/Source: Non-Prime Times Sub-prime lenders must sense the famous saying all the time nowadays, because the more things change, the more they stay the same. Sure, the industry is in a drastically different place today compared to five or even 10 years ago. Today, there are a bevy of data analytics and technology platforms to…

Read MorePart I of recovery commentary: Skip-tracing strategy and measuring value

Author: Joel Kennedy, NAF Association Source: SubPrime Auto Finance News Editor’s note: This commentary is the first in a series compiled by Joel Kennedy, who is the current president of the National Automotive Finance Association and Chief Operating Officer at TruDecision, looking at the intricacies of repossessions and recovery. The industry that locates borrowers and…

Read MoreFrom the editor: A crisis facing repossession agents

Article from: SubPrime Written by: Nick Zulovich DALLAS – While the overall automotive industry might be relatively healthy, no doubt there are dealerships struggling with aged inventory, auctions stressed to keep commercial consignors satisfied and finance companies wringing their hands over compressed margins and wavering portfolio performances. But if you would please indulge me…

Read MoreAn interview with Michael Levison, CEO Resolvion Skip Trace & Repossession Management Services.

Interviewed by: Bob Rinaldi, LLC This video series is about how technology is remaking the historically fractured market of repossession services. Technology in this series is more of an overriding term for several capabilities that have come of age from the conceptual drawing board to tangible, useful, and paradigm changing applications. The use of…

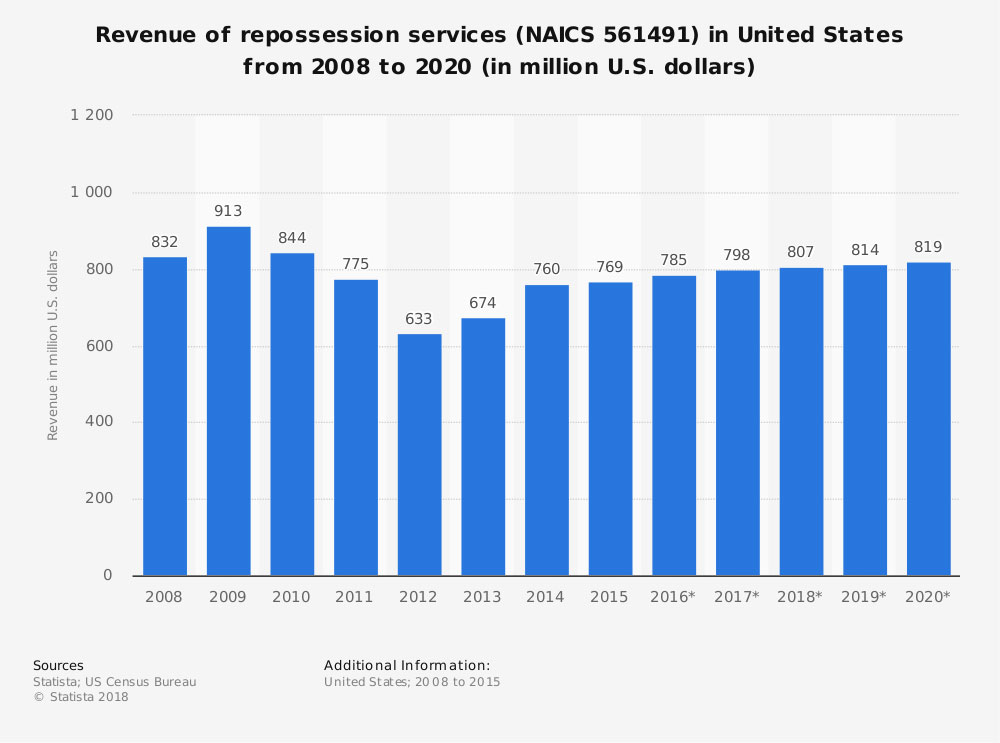

Read More22 Repo Industry Statistics, Trends & Analysis

Article from: https://brandongaille.com/22-repo-industry-statistics-trends-analysis/ The repo industry is involved in the business of repossession. When consumers default on a loan, such as a car loan, then a lien on that item can be activated. The consumer can be ordered to turn the product over because of the lien. Most owners refuse to do so. That’s…

Read More